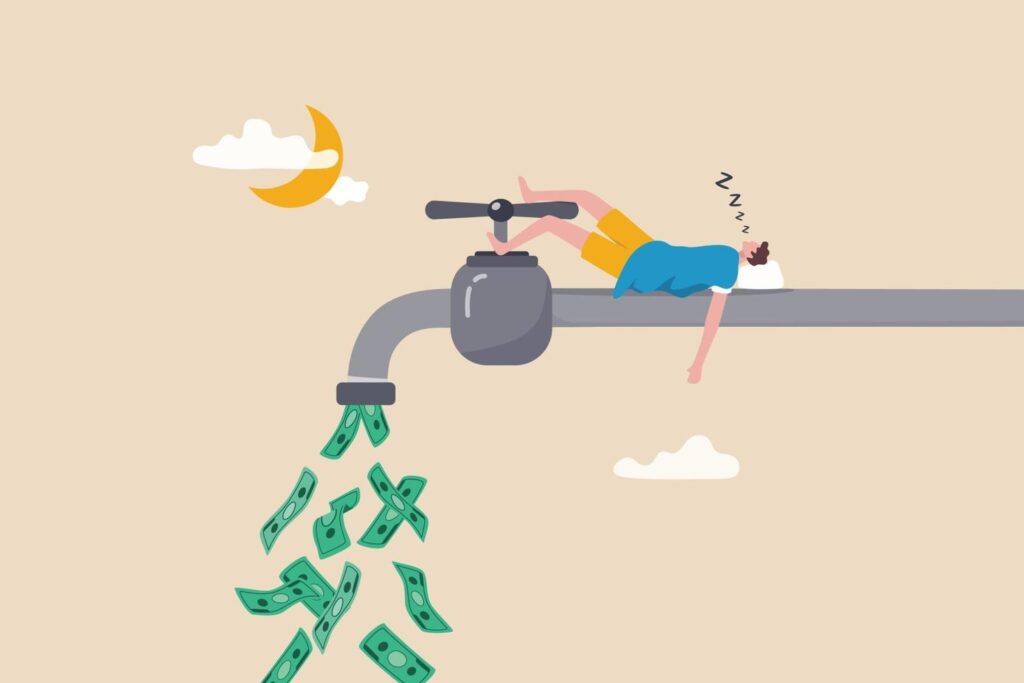

In 2025, generating passive income is a primary financial goal for millions of individuals, particularly millennials who are actively focused on building multiple income streams to achieve financial independence and hedge against inflation. Passive income—money earned with minimal ongoing effort—is highly sought after for its ability to build wealth while you sleep. The key in 2025 is a diversified approach, from traditional sources like dividend stocks and rental income to modern opportunities such as crypto staking.

Here are seven effective ways to make money passively in 2025.

The Millennial Push for Passive Income

The pursuit of financial resilience has intensified in 2025, driven by economic uncertainty and the desire for wealth building that is less tied to traditional 9-to-5 employment. Millennials, in particular, are strategically investing in securing passive income sources and are not putting all their eggs in one basket, such as the challenging 2025 real estate market (characterized by high mortgage rates and low inventory). They are leveraging technology and diverse investment vehicles to build robust, diversified financial portfolios.

7 Ways to Generate Passive Income in 2025

1. Dividend-Paying Stocks and Funds

Investing in dividend-paying stocks or exchange-traded funds (ETFs) is a classic, reliable passive income strategy. These companies distribute a portion of their profits to shareholders regularly.

- How it works: You invest in established, stable companies or diversified funds that have a history of paying dividends. The cash is deposited directly into your brokerage account.

- Why it works in 2025: In a volatile stock market, dividends provide a stable cash flow and can help offset inflation (CPI up 2.7% in 2025). Many ETFs focus specifically on dividend growth.

- Success Tip: Reinvesting dividends automatically through a “DRIP” (Dividend Reinvestment Plan) supercharges the power of compound interest, significantly increasing your long-term wealth.

2. High-Yield Savings Accounts (HYSAs)

While HYSAs are not a high-growth investment, they are an essential place to store an emergency fund or idle cash, generating passive interest income that actually matters.

- How it works: You move money from a traditional savings account (earning <0.50% APY) to an online-only high-yield account.

- Why it works in 2025: With top HYSAs offering rates around 4.50% APY in late 2025, they provide a competitive, passive return that helps offset the 2.8% core inflation rate.

- Success Tip: Use online banks like Bask Bank or Ally Bank for the best rates and automatic transfers to ensure consistent passive saving.

3. Rental Income from Real Estate

Owning physical rental property is one of the most powerful and time-tested passive income streams, offering cash flow, tax advantages, and property appreciation.

- How it works: You purchase a property, manage it (or hire a property manager), and collect rent that exceeds your expenses (mortgage, taxes, insurance, maintenance).

- Why it works in 2025: Real estate acts as a strong inflation hedge, as rents typically rise with inflation. The current market, while difficult to enter with high rates (around 7%), means existing landlords have leverage.

- Success Tip: Research your market thoroughly and focus on areas with high rental demand. Be prepared for occasional active management during tenant turnover or major repairs.

4. Crypto Staking and Lending

For those comfortable with the digital asset market, crypto staking is a modern form of passive income similar to earning interest in a savings account.

- How it works: You “stake” your cryptocurrency holdings (e.g., Ethereum) to help validate transactions on a proof-of-stake blockchain. In return, you earn a percentage yield in additional cryptocurrency.

- Why it works in 2025: Staking rewards can be highly competitive (often 4%–10%+ APY), providing a significant income stream in the growing digital economy.

- Success Tip: Use established, secure platforms or a hardware wallet to stake directly. Be aware of the risks, including potential “slashing” penalties or market volatility.

5. Selling Digital Products

This is a powerful side hustle that evolves into a passive income stream. The work is upfront, but the sales are passive.

- How it works: Create an e-book, a printable template (e.g., a budget spreadsheet), a course, or a software plugin. List it on platforms like Etsy, Gumroad, or your own website.

- Why it works in 2025: The digital economy is booming, and the cost of replication is zero. Once created, you can sell infinite copies with no inventory costs.

- Success Tip: Choose a niche where you have expertise and where there is proven demand. Focus on solving a specific problem for your audience.

6. Peer-to-Peer (P2P) Lending and Renting Assets

Leverage underutilized assets you already own or participate in lending platforms to generate income.

- How it works: Rent out a spare room on Airbnb, your car on Turo, or lend money via P2P platforms (though these carry higher risk).

- Why it works in 2025: The gig economy makes it easy to monetize assets on demand, providing flexible income streams.

- Success Tip: Understand the tax implications and insurance requirements for renting out assets.

7. Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission for every sale made through your unique link.

- How it works: This is best paired with content creation (a blog, YouTube channel, or social media presence). You build trust with an audience and recommend products you genuinely use.

- Why it works in 2025: It is a performance-based income stream that scales with your audience size.

- Success Tip: Honesty is crucial. Only promote products you believe in, and always disclose that you are using affiliate links to maintain audience trust.

By combining several of these passive income streams, individuals in 2025 can build a resilient financial foundation that helps them navigate inflation and work towards true financial freedom.