In 2025, the performance comparison between cryptocurrency and traditional investments like the S&P 500 highlights a stark trade-off between volatility and potentially explosive returns. While the stock market offers stability and predictability, cryptocurrencies have delivered superior performance metrics, with Bitcoin (BTC) outperforming the S&P 500 significantly over recent periods. This has resulted in a high profitability rate for digital asset holders, though this comes with substantially higher risk.

Performance Metrics: Crypto vs. S&P 500

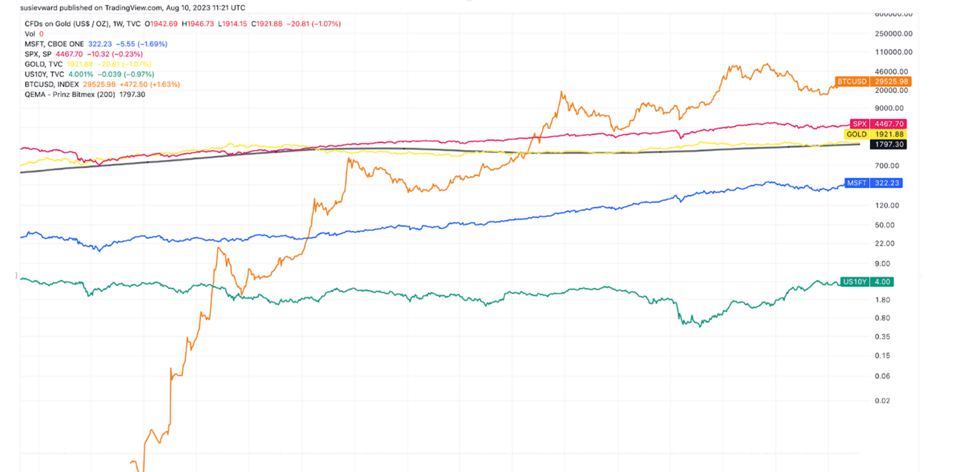

Comparing the two asset classes reveals dramatic differences in scale of returns. The year 2024 provides a clear recent example of crypto’s potential upside:

- Bitcoin (BTC): Achieved a remarkable gain of +121.5% in 2024, reaching a high of $108,135 by December of that year.

- S&P 500: The S&P 500, the benchmark for large-cap U.S. stocks, offered solid but comparatively modest returns, typically in the range of 10%–25% for the year, depending on the exact timeframe.

The Profitability Factor

The high performance of cryptocurrencies translates into significant profitability for investors who entered the market at earlier stages. Data suggests that 69% of all cryptocurrency owners are currently in profit as of late 2025, a testament to the powerful bull runs the market has experienced. This contrasts with traditional markets, where profitability is more uniform but generally less extreme.

Volatility Analysis: The Core Differentiator

The main reason for these differing performance metrics is volatility. Volatility measures how quickly and dramatically an asset’s price can change.

- Cryptocurrency Volatility: Crypto assets are highly volatile. A 20% price swing in a single day is not uncommon. This high volatility is the source of massive gains, but also of significant, rapid losses.

- Traditional Market Stability: The S&P 500 is relatively stable. While corrections and bear markets occur, single-day percentage swings are generally much smaller than those seen in crypto.

Investors choosing crypto must have a high risk tolerance and a long-term investment horizon to weather these fluctuations. Strategies like dollar-cost averaging (DCA) are essential for managing risk in volatile markets.

Risk vs. Reward: A Summary Comparison

| Feature | Cryptocurrency (e.g., Bitcoin, Ethereum) | Traditional Investment (e.g., S&P 500 ETF) |

|---|---|---|

| Average Return Potential | High (often triple digits in bull cycles) | Moderate (historically ~10% annually) |

| Volatility Level | Extremely High | Low to Moderate |

| Liquidity | High (24/7 trading) | High (market hours trading) |

| Regulation | Evolving, increasing in 2025 | Highly regulated and mature |

| Accessibility | Global, 24/7 (DeFi) | Accessible via brokerage accounts |

| Risk Profile | High risk, high reward | Moderate risk, stable growth |

The 2025 Landscape: Institutional Integration

The landscape in 2025 is evolving rapidly with the integration of crypto into traditional finance (TradFi).

- Crypto ETFs: The approval of spot Bitcoin and Ethereum ETFs has brought billions in institutional inflows, bridging the gap between the two worlds and providing a regulated, accessible way to invest in crypto through traditional brokerage accounts.

- Asset Tokenization: The rise of tokenization allows traditional assets like real estate to become more liquid and accessible via blockchain technology, creating hybrid investment opportunities.

In conclusion, for investors seeking aggressive growth and willing to accept high risk, cryptocurrency continues to outperform traditional investments. For those prioritizing stability and predictable returns, the stock market and other traditional assets remain the standard. The choice ultimately depends on an individual’s financial goals, risk tolerance, and time horizon.